Amazon best practice: Using Amazon’s VAT calculation service VCS

This best practice informs you about Amazon’s VAT calculation service VCS and explains what to consider when setting VCS up in PlentyONE.

An overview of VCS and an instruction how to activate it in PlentyONE can be found on the Amazon page of the manual.

You can use two different VCS options in PlentyONE:

-

VCS Amazon (invoices are generated by Amazon)

-

VCS PlentyONE/VCS Lite (invoices are generated by PlentyONE)

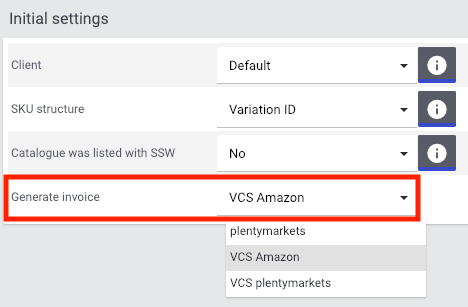

In PlentyONE. Amazon VCS is activated in the Setup » Markets » Amazon » Settings » [Select Amazon account] » Tab: Settings menu with the Generate invoice option.

|

Requirements for using VCS

If you would like to use VCS, some requirements have to be met:

|

|

Workflow when you ship orders yourself (MFN)

Keep in mind that you have to send a shipping confirmation prior to generating the invoice. Therefore, if you export items outside of the EU, you only receive the invoice in the VCS report from Amazon after having confirmed the shipment. |

1. VCS Amazon (invoices are generated by Amazon)

Things to know

-

The order numbers of the orders in PlentyONE must be synchronised with the Amazon order numbers. Otherwise, invoices cannot be generated by Amazon with VCS.

-

The process is fully automated. You neither have to manually generate invoices nor create an event procedure.

-

If you use this VCS option (=VCS Amazon), invoices for all Amazon orders (MFN, FBA, B2B) are automatically generated by Amazon.

-

Invoices cannot be generated in any other way (for example, invoices can no longer be generated manually or with an event procedure).

-

VAT numbers are imported into PlentyONE.

-

The total order value of order items is imported into PlentyONE.

Workflow: Invoice generation by Amazon

-

Orders are created during the order import.

-

The system blocks manual invoice generation for Amazon orders.

-

A new tax report is created by Amazon on a daily basis (type: SC_VAT_TAX_REPORT) and imported into PlentyONE.

-

VAT numbers are imported into PlentyONE. if available.

-

The imported tax report (type: SC_VAT_TAX_REPORT) creates an external invoice document for orders which contains the Amazon invoice number.

Note: Invoices will not be downloaded. The document is merely an external document which cannot be retrieved. It is created for the financial export.

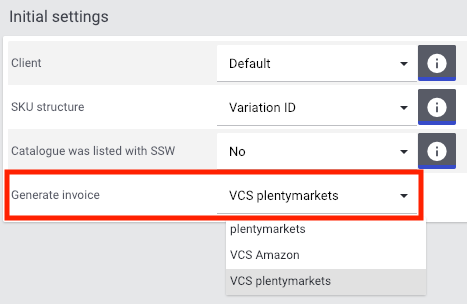

2. VCS PlentyONE (invoices are generated by PlentyONE)

Things to know

-

The order numbers of the orders in PlentyONE must be synchronised with the Amazon order numbers. Otherwise, invoices cannot be generated by PlentyONE with VCS.

-

The items’ SKUs in PlentyONE must be synchronised with the Amazon SKUs. Otherwise, invoices cannot be generated by PlentyONE with VCS.

-

The process is fully automated. You neither have to manually generate invoices nor create an event procedure.

-

If you use this VCS option, i.e. the VCS PlentyONE option, invoices for all Amazon orders (MFN, FBA, B2B) are automatically generated by PlentyONE.

-

Invoices cannot be generated in any other way (for example, invoices can no longer be generated manually or with an event procedure).

-

Currently, the order/the invoice cannot be cancelled later on (for example if the invoice address should be changed).

Workflow: Invoice generation by PlentyONE

-

Orders are created during the order import.

-

The system blocks manual invoice generation for Amazon orders.

-

A new Amazon order report (type: VIDR) is requested on an hourly basis and imported into PlentyONE.

-

The imported order report (type: VIDR) readjusts the sums of the orders that were already imported.

-

With the new and corrected sums, invoices are generated automatically and uploaded to Amazon.

2.1. VCS PlentyONE. How to find errors

Currently, the following possibilities are available to find sources of errors when generating Amazon invoices with PlentyONE:

-

The order itself

-

Logs

-

Plugin

Identifying potential sources of errors

-

Whether an invoice was created for the order can be seen in the order itself.

-

Whether VCS reports are imported into PlentyONE can be checked in the Data » Log menu with the identifier importVCSConnection.

-

Whether sales tax IDs are imported and adjusted can be checked in the Data » Log menu with the identifier importVCSConnection.

-

Whether invoices are uploaded correctly, or whether they are uploaded at all, can be checked in the Data » Log menu with the identifier VCS invoice upload.

-

If you activated the VCS dashboard plugin in your PlentyONE system, then you can check potential problems with data synchronisation between Amazon and PlentyONE in a separate menu. The plugin is available in the plentyMarketplace.

If the identifiers listed above are not available in the log or if there are no entries for these identifiers, then the process was not executed yet.